Due Diligence / Valuation Services

AN ITPS DUE DILIGENCE ANALYSIS CAN BE THE KEY TO A FACILITY’S FUTURE

While our industry is resilient, and always bounces back in the wake of economic uncertainty, it stands to reason that even long-established leisure facilities can face setbacks and challenges. In such instances, it is important to determine what the problem might be, analyze the alternatives to be considered, and implement action accordingly.

This action might be modifications to the existing operation that would improve profitability, a major re-direction and re-identification that would re-establish the facility in the marketplace, a facility closure, or a facility sale. ITPS has been retained in many situations wherein a leisure project faced similar circumstances.

In these cases, ITPS can provide a Due Diligence Analysis. This analysis can can take many forms, such as an in-depth business audit, a property valuation, a capital expansion plan recommendation, or a turnaround strategy. In the end, a Due Diligence Analysis by ITPS would eventually lead to a proper valuation or asessment that would be the foundation for recommendations for improved performance or for eventual sales.

A Due Diligence Analysis can include, but is not limited to, an assessment of a facility’s physical property and its market position, as well as a review of its admissions, attendance, operations, programs, and financial programs or positions. For the leisure property owner or for a potential lender who is considering either a sale, a purchase, or a turnaround, a Due Diligence Analysis is beneficial in producing specific results. These can include:

1. An in-depth analysis of overall operations. This analysis leads directly to recommend programming changes that would produce improved efficiency, productivity, service, and profit.

2. A short- or long-range capital expansion program. This ITPS-recommended capital expansion program will be designed to increase attendance, improve guest satisfaction, and ensure future growth and success.

3. A general assessment of the property, its components, and its operation. This assessment would provide reliable documentation in the event of an anticipated change of ownership, equity participation, or sale of property/assets.

ITPS has the experience to review existing leisure operations and provide proven and valid strategies for either improvement and turnaround, or for positioning for acquisition. ITPS has performed these types of reviews for theme parks, amusement parks, waterparks, animal parks, entertainment centers, aquariums, museums, and stand-alone attractions.

The following are just a few of the types of Due Diligence Analyses ITPS has completed for various leisure operators and/or banks and lending institutions.

Parques Reunidos, Spain

(Client: Parques Reunidos)

Property, product, and facility review of various properties leading to sales and acquisitions

Legoland / Bollywood / MotionGate Developments, Dubai

(Client: Bank of China Middle East)

Review of Business Plan to provide insight on reasonableness of content, as a basis to a decision on investment by the bank

The Enchanted Kingdom Theme Park, Philippines

(Client: Amtrust Holdings)

After leading the opening of this park, ITPS provided maintenance and safety audits for three operating years to ensure the park continued to offer high levels of safety and service

California’s Great America Theme Park, Santa Clara, California, USA

(Client: JMA Ventures, LLC)

Operations and physical park review with suggestions for product or operational changes, as a foundation to JMA Venture’s potential purchase of the property

Union Station (Museum), Kansas, USA

(Client: Union Station)

Business and operational review leading to recommended program changes for efficiency, productivity, service, marketing, and profitability

N-Kid Indoor Operations, Vietnam

(Client: ICG Strategy and Standard Chartered)

Due Diligence and operational review.

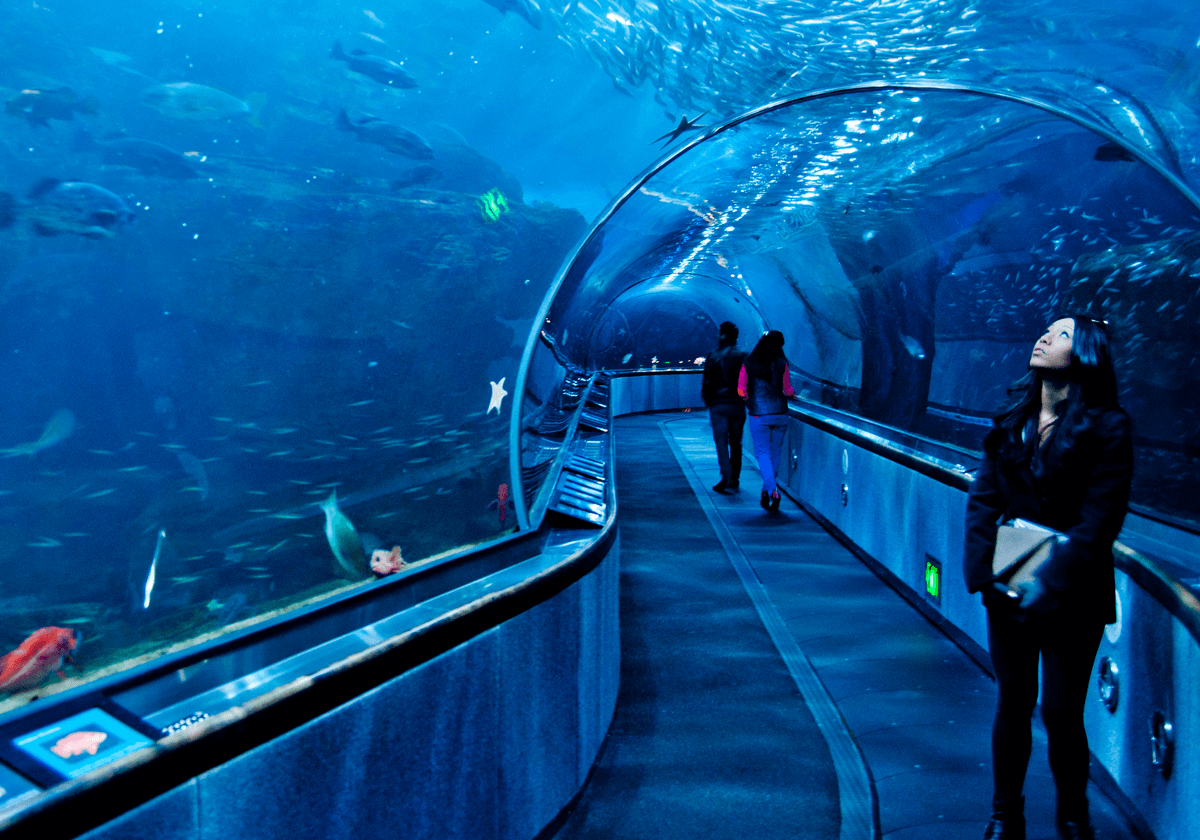

Underwater World, California, USA

(Client: Kirkland & Ellis)

Due diligence operational audit leading to program and product enhancements

Warner Bros Theme Park, Abu Dhabi

(Client: Farah Leisure)

Three ride operational audits during first operating year (one pre-opening and two during first operating year) to assure proper procedures for safety and efficiency, and proper training techniques.

Village Roadshow Theme Parks

(Client: Pacific Equity Partners)

On-site operational review to ascertain level of effectiveness, efficiency, and safety as a basis for potential purchase of multiple theme park operations

Ripley’s Aquariums, USA properties

(Client: Bank of America)

In 2003, ITPS was retained by Bank of America to conduct a business valuation of the existing Ripley’s Aquarium in Myrtle Beach, South Carolina as well as Ripley’s Aquarium of the Smokies in Gatlinburg, Tennessee and to provide an independent assessment of its value. In preparing the valuation originally submitted in October of 2003, ITPS conducted an on-site review of the Ripley’s Aquarium property and operation in Myrtle Beach. On-site and subsequent review of documentation and materials led to the completed Business Valuation.

Royal Caribbean Cruise Lines (RCCL), Bahamas / Caribbean

(Client: Royal Caribbean)

On-site audit and review of traffic flow and operational procedures on island attraction operations, leading to recommendations for improvements for safety and efficiency

Seabreeze Amusement Park, Rochester, New York, USA

(Client: Seabreeze Amusement Park)

Independent, third-party review of internally-completed business valuations and provision of ITPS expert opinion of that value

Jazzland Theme Park, New Orleans, Louisiana, USA

(Client: SouthTrust Bank, Birmingham, Alabama)

ITPS was retained by SouthTrust Bank of Birmingham, Alabama to conduct a valuation of the existing Jazzland Theme Park (New Orleans, Louisiana) operation. The purpose of this assignment was to provide an independent valuation of Jazzland, based on the following approaches: fair market value based on capitalized financial performance; and, fair market value and liquidation value based on equipment and property assets, both real and personal property. In preparing this valuation, ITPS conducted an on-site inspection and review of the Jazzland Theme Park property and operation in 2002.

La Ronde, Montreal, Canada

(Client: La Ronde Amusement ParK)

ITPS was asked by the owners of La Ronde Amusement Park in Montreal, Canada to perform a Ride Evaluation Report of the rides on its property. The report contained:

*A brief evaluation of each ride.

*The manufacturer and date of manufacture for each ride.

*The original purchase price of the ride.

*The present market value range for each ride.

*Photographs and videotapes substantiating the findings presented in the written report.

Coney Island Amusement / Waterpark, Cincinnati, Ohio, USA

(Client: Coney Island)

Review and analysis of current attraction mix and provision of recommendations for improvements to existing product which would lead to enhanced entertainment value.

Hersheypark, Hershey, Pennsylvania, USA

(Client: Hershey Parks & Resorts)

Three ride operational audits annually for three consecutive years to assure proper operating efficiencies and safety approaches, as well as the provision of recommendations for improvements

Cincinnati Zoological Park and Botanical Garden, Cincinnati, Ohio USA

(Client: Cincinnati Zoo)

Various assignments, including analysis of RFP submittals relative to the food and beverage program; analysis of guest circulation; general contract review for a major new attraction; overall retail operations review; and provision of operating manuals and training for a train ride.

Toledo Zoo – Ohio, USA

(Client: Toledo Zoo)

In-depth study of vehicular traffic, grounds and departmental functions, with recommendation provided to reduce / eliminate vehicular traffic during park hours

Kangaroo Conservation Center, Dawsonville, Georgia, USA

(Client: Kangaroo Conservation Center)

Business review of the operation and property, with recommendations for improvements in operational aspects and in product offering; also reviewed overall image and identity

Bronx Zoo, New York, USA

(Client: The Wildlife Conservation Society)

Admissions pricing analysis leading to recommendations on enhanced pricing structures; financial impact analysis showing implementation scenario

Magic Waters Waterpark / Rockford Park District, Illinois, USA

(Client: Rockford Park District)

Analysis of operations after failure to perform to projections, leading to an in-depth renovation and expansion program designed to improve performance

Hard Rock Park, Myrtle Beach, South Carolina, USA

(Client: HRP Trustees, the investor group)

Due Diligence, Business/Operations Review and Strategic Recommendations Report.

ITPS provided an assessment of the general operational approach taken by developers and operators of Hard Rock Park and to provide a sales valuation of the property. The park sold at the value stated by ITPS.

Colorado’s Ocean Journey, Denver, Colorado, USA

(Client U.S. Bank National Association as Trustee, Denver, Colorado)

ITPS was retained by U.S. Bank National Association as Trustee for Colorado’s Ocean Journey Aquarium to provide a Business/Operations review. The purpose of this review was to provide an examination of the overall business and operations at Ocean Journey, leading to any necessary recommended program changes that could potentially improve efficiency, productivity, service, and profitability. The ultimate goal was to determine the value of the facility and then attempt to sell the property. ITPS was also retained as sales agent to offer Ocean Journey for sale.

Playcenter Amusement Park – Sao Paulo, Brazil

(Client: Playcenter)

Ongoing, on-site operational audits provided on the primary Playcenter operation in Sao Paulo, reporting on all aspects of operation and guest service

Chapultepec Park – Mexico City, Mexico

(Client: Grupo Magico)

Ongoing, on-site operational audits performed, with reporting and recommendations provided on all aspects of operation and guest service

Magical Midway, Orlando, Florida, USA

(Client: Magical Midway, Inc. & John B. Morgan)

ITPS was retained by Magical Midway of Central Florida, Limited; Magical Midway, Inc.; and, John B. Morgan, Robin Turner, and Barry Frank, to perform an independent valuation of the Magical Midway operation in Orlando, Florida as an ongoing concern.

Nellie Bly Amusement Park, Bronx, New York, USA

(Client: NBKL Corporation)

ITPS was retained by the NBKL Corporation, current owners of Nellie Bly Park, to conduct a business valuation of the amusement park in Brooklyn, New York. ITPS valued Nellie Bly Park as based on the following two approaches: Fair market value based on capitalized financial performance; and, Market value, replacement value, and liquidation value based on equipment and property assets, both real and personal property.

Six Flags Corporation, Dallas, Texas, USA

(Client: Six Flags Corporation)

The Six Flags Corporation asked ITPS to conduct an independent asset valuation of these Six Flags properties:

Six Flags Over Texas – Dallas, Texas

Six Flags Over Georgia – Atlanta, Georgia

The valuation included a general examination of rides, attractions, food/beverage, merchandise, games and support facilities. Discussions with management focused on past expenditures and the current operation. The assignment centered on estimating the value of these two properties using the “cost approach” method, or one based on existing assets. Specifically, ITPS used the market value of underlying assets method in order to determine a value for the business based on individual asset values. This method assumes that the value of a business will be realized as part of an ongoing concern, not one that is liquidated. It also reflected tangible assets at book value, including original asset cost, estimated market value and estimated replacement value. All areas of the valuation were broken down by the ride/attraction/buildings and included such items as year of service, original amount, replacement value and minimum/maximum range for each piece of equipment. This valuation encompassed several months of on-site and in-house due diligence by the ITPS team in order to provide an in-depth and detailed report for the Six Flags corporation.

Visionland Theme Park, Bessimer, Alabama, USA

(Client: SunTrust Bank, Tampa, Florida)

ITPS was retained by SunTrust Bank (as Trustee for the West Jefferson Amusement and Public Park Authority), to conduct a Business/Operations Review of the VisionLand operation in Bessemer, Alabama. The purpose of this review was to provide an examination of the overall business and operations at VisionLand, leading to any necessary recommended program changes that could potentially improve efficiency, productivity, service, and profitability.

ITPS also conducted a property valuation of VisionLand. The purpose of this valuation is to provide an independent assessment of the value of VisionLand, based on the following approaches: fair market value based on capitalized financial performance, and, fair market value, replacement value, and liquidation value based on equipment and property assets, both real and personal property. ITPS was also retained as sales agent to offer VisionLand for sale.

SuperSplash! Adventure, Edinburgh, Texas, USA

(Client: Chase Bank, the trustee)

ITPS was retained to provide an on-site evaluation of the operation, followed by recommendations that we believed would lead to improved results. Following this, ITPS was retained to provide a General Manager on-site for a period of two years. ITPS was also retained as sales agent to offer SuperSplash! for sale.

La Ronde, Montreal, Canada

(Client: La Ronde Amusement Par)

ITPS was asked by the owners of La Ronde Amusement Park in Montreal, Canada to perform a Ride Evaluation Report of the rides on its property. The report contained:

*A brief evaluation of each ride.

*The manufacturer and date of manufacture for each ride.

*The original purchase price of the ride.

*The present market value range for each ride.

*Photographs and videotapes substantiating the findings presented in the written report.

Beijing Amusement Park, People’s Republic of China

(Client: Kumagai Gumi)

Operational and leisure audit, due diligence product review leading to action plan and on-site management for 7 years)

Six Flags Assessment, USA properties (Client: Warner Communications, the potential investor)

Warner Communications, Inc., the entertainment arm of Time Warner, Inc., completed a major stock purchase into the Six Flags Corporation, a premier amusement/theme park operator in the leisure industry. Prior to their final decision as to the viability of such a purchase, Warner Communications, Inc. requested that an analytical assessment of the Six Flags system be conducted by a highly respected, professional leisure firm.

To that end, Warner Communications, Inc. contracted ITPS to perform a Due Diligence Assessment of the Six Flags Corporation. This assignment included in-depth and on-site reviews of the assets and operations of each Six Flags park to include Six Flags Magic Mountain (Valencia, California), AstroWorld (Houston, Texas), Six Flags Over Texas (Arlington, Texas), Six Flags Over Mid-America (Eureka, Missouri), Six Flags Great America (Gurnee, Illinois), Six Flags Great Adventure (Jackson, New Jersey) and Six Flags Over Georgia (Atlanta, Georgia).

Concentrating on areas such as capital expenditure programs, long-range plans, operating history, asset maintenance, ride operations, safety, ride maintenance, retail operations, admissions policies, attendance trends, financial projections and capacity characteristics, ITPS developed an executive summary for Warner Communications, Inc., which led to the decision to finalize the initial $30 million stock purchase of the Six Flags Corporation.

Tierco Properties, USA

(Client: Tierco Properties)

ITPS was twice contracted by Tierco Properties (former Premier Parks and now Six Flags Theme Parks) to perform a Properties Valuation, or an independent professional business valuation and asset appraisal on all their property/equipment currently owned by Premier Parks and its three existing facilities:

Frontier City – Oklahoma

White Water Bay – Oklahoma

Wild World – Maryland

Tierco was asked for both of these valuations by Chemical Bank. An excerpt from a letter sent to ITPS by the President of Premier Parks (as it was known) included this statement: “Chemical has reviewed your previous valuation and is comfortable with your methodology.”

ITPS conducted on-site interviews with owners and managers of each property, focusing on past, present and future capital development plans, financial plans and marketing programs. The valuation of each property was based on (1) the income capitalization method using historical operating cash flow and projected cash flow, and (2) the estimated replacement value and liquidation value of each ride and piece of equipment.

ITPS subsequently updated its valuation of all assets including all additional assets since the last report.

Kings Entertainment Parks Assessment, USA

(Client: Paramount Communications Company, the investment group)

Paramount Communications/Madison Square Garden contracted with ITPS on a fast-track basis to provide a complete due diligence valuation on these properties owned by Paramount:

Kings Dominion – Richmond, VA

Great America – Santa Clara, CA

Carowinds – Charlotte, NC

Canada’s Wonderland – Toronto, Canada

Based on the ITPS design/operating and management experience, not only did ITPS review and provide valuation for the assets, we also examined and reported on such issues as:

Standard Operating Procedures; Capacities (Ride; Parking Lot; Food; Merchandise/Games); Safety/Maintenance; Live Entertainment; Data Processing; Financial Review (historical, current and future); Review of Debt Structure, Financial Statements, Tax Structures; Sponsorships; Advertising; and Staffing Levels, etc.

Contact ITPS

International Theme Park Services, Inc.

2200 Victory Parkway, Suite 500A

Cincinnati, Ohio 45206

United States of America

Phone: 513-381-6131

http://www.interthemepark.com

itps@interthemepark.com