Business Audits, Reviews and Turnaround Strategies

While our industry is resilient, and always bounces back in the wake of economic uncertainty, it stands to reason that even long-established leisure facilities can face setbacks and challenges. In such instances, it is important to determine what the problem might be, analyze the alternatives to be considered, and implement action accordingly.

This action might be modifications to the existing operation that would improve profitability, a major re-direction and re-identification that would re-establish the facility in the marketplace, a facility closure, or a facility sale. Sometimes, we were asked to simply provide a business audit leading to a valuation for sales purposes. Other times, we were asked to provide a business audit that would lead to a turnaround strategy for improved performance.

The following is a selected listing of our project work that relate to this area. This listing includes work we have done wherein a facility faced uncertainty, and required an evaluation, an audit, a strategy plan, or recommendations for future action.

Coney Island / Cincinnati, Ohio

ITPS was retained by the ownership / management team of Coney Island, located on the Ohio River in Cincinnati, to carefully examine its current attraction mix in terms of appropriateness, balance, general appeal, and adherence to leisure trends as a foundation for future growth. Specifically, Coney Island management wanted to receive recommendations for the highest and best use of its existing Moonlight Pavilion, taking into account how this use would fit with the park’s overall offerings. In its role, ITPS gave specific consideration to the facility’s main businesses and considered opportunity for proper cross-pollination. ITPS determined needs relating to overall product and recommended changes to the existing product in terms of relocation or consideration for removal. These recommendations were made with the ultimate goal of enhancing in-park spending, capacity levels, attendance levels, safety, and overall entertainment value and appeal.

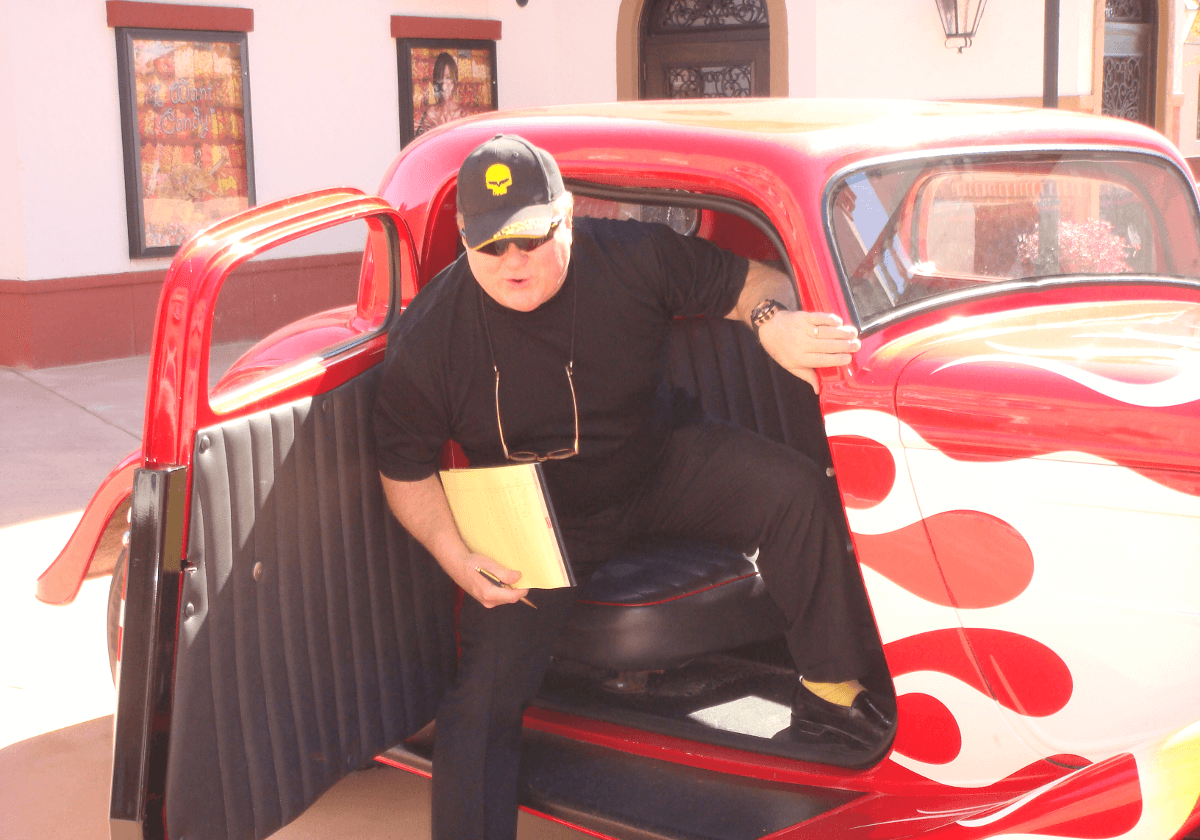

Colorado’s Ocean Journey Aquarium / Denver, Colorado

Colorado’s Ocean Journey Aquarium opened in 1999. Sagging attendance and high costs forced the nonprofit company that built and operated the $93 million aquarium to file for bankruptcy in 2002. In 2002, ITPS was contracted by the U.S. Bank National Association as Trustee for Colorado’s Ocean Journey Aquarium to perform a due diligence and business/operations review for Colorado’s Ocean Journey Aquarium. ITPS provided a review of overall operations leading to recommended program changes that would produce improved efficiency, productivity, service and profitability. Additionally, ITPS assisted in the sale of the facility, which was sold at the value estimated by ITPS in its report.

Six Flags, Inc. / Time Warner Communications

Warner Communications, Inc., the entertainment arm of Time Warner, Inc., completed a major stock purchase into the Six Flags Corporation, the premier operator of regional theme parks in the United States. Prior to their final decision as to the viability of such a purchase, Warner Communications, Inc. requested that a highly respected, professional leisure firm conduct an analytical assessment of the Six Flags system. To that end, Warner Communications, Inc. contracted ITPS to perform a "Due Diligence Assessment" of the Six Flags Corporation. This assessment included in-depth and on-site reviews of the assets and operations of each of the Six Flags’ parks. To be included were: Six Flags Magic Mountain (Valencia, California), AstroWorld (Houston, Texas), Six Flags Over Texas (Arlington, Texas), Six Flags Over Mid-America (Eureka, Missouri), Six Flags Great America (Gurnee, Illinois), Six Flags Great Adventure and Wild Animal Safari (Jackson, New Jersey) and Six Flags Over Georgia (Atlanta, Georgia).

Hard Rock Park / Myrtle Beach, South Carolina

In 2008, Hard Rock Park opened in Myrtle Beach and subsequently closed at the end of its first operating season, with doubts about re-opening. Prior to the end of the first operating season, investment groups and banks retained ITPS to perform a series of evaluations on possible reasons the park was failing and what potential the park had for the future. In this role, ITPS conducted a feasibility analysis to determine the park’s actual potential and conducted a due diligence / business audit to determine the park’s current operating status. These analyses led to the ITPS suggestion that the park was not a good fit in that market, was not properly designed, and that it should not re-open in its current state. As a result, park investors opted not to re-open the park and subsequently sold it, based on the ITPS-recommended selling price.

Jazzland Theme Park / New Orleans, Louisiana

ITPS was retained by SouthTrust Bank of Birmingham, Alabama to conduct a valuation of the existing Jazzland Theme Park (New Orleans, Louisiana) operation. The purpose of the assignment was to provide an independent valuation of Jazzland, based on the following approaches: (a) fair market value based on capitalized financial performance; and (b) fair market value and liquidation value based on equipment and property assets, both real and personal property. In preparing this valuation, ITPS conducted an on-site inspection and review of the Jazzland Theme Park property and operation in 2002. ITPS also prepared a modified version of the existing feasibility study, reducing the park’s projections by more than half. The ITPS projections were more in line with how the park actually performed.

California’s Great America / Santa Clara, California

In 2011, ITPS was engaged by JMA Ventures, LLC of San Francisco, California to provide a Due Diligence, Business / Operations and Physical Park Review of California’s Great America Theme Park in Santa Clara, California as a foundation to JMA Venture’s potential purchase of said property. As predecessor to the document provided, ITPS senior personnel visited California’s Great America property and undertook a thorough review of the park’s operation and overall assets. ITPS then provided consultation and assistance in executing a due diligence and turnaround strategy for the park. The ultimate goal was to provide a review of the overall operations of the park leading to suggestions of either product or operational changes that would be needed to improve efficiency, productivity, service, marketing and profitability. JMA Ventures utilized the ITPS report as its basis to determine viability for its purchase of the park.

SuperSplash Waterpark / Edinburgh, Texas

ITPS was retained to provide an on-site evaluation of the SuperSplash operation, followed by recommendations that we believed would lead to improved results. Following this, ITPS was retained to provide a General Manager on-site for a period of two years. ITPS was also retained as sales agent to offer SuperSplash for sale.

Kangaroo Conservation Center / Dawsonville, Georgia

Located on over 87 acres in the North Georgia mountains, the Kangaroo Conservation Center is the largest collection of kangaroos outside of Australia. ITPS provided a detailed Business Review of the Center in order to analyze the current situation and provide recommendations to improve the operation of the facility. ITPS reviewed the Center’s historical and current performance of attendance, pricing, revenues, and operating expenses. Additionally, a complete review of the overall product offering as well as the image/identity were examined. ITPS also evaluated the organization structure, maintenance & safety, retail operations and the Center’s marketing programs. ITPS then made recommendations for improvement in all the above areas.

New York Wheel / Staten Island, New York

ITPS was engaged to perform an analysis and review of the proposed New York for a potential sponsor. ITPS provided a complete review of the feasibility of the project and provided analysis to the client to determine if they should provide sponsorship of the wheel.

City of Mississauga

ITPS was contracted by the City of Mississauga to perform a review of a proposed leisure attraction development on city owned property. ITPS worked with the core team and steering committee of the City of Mississauga to develop a list of due diligence requirements to be satisfied by the Developer in order to assess the viability of the proposal and the Developer. ITPS fully reviewed the feasibility analysis for the project and conducted an analysis of the study with recommendations.

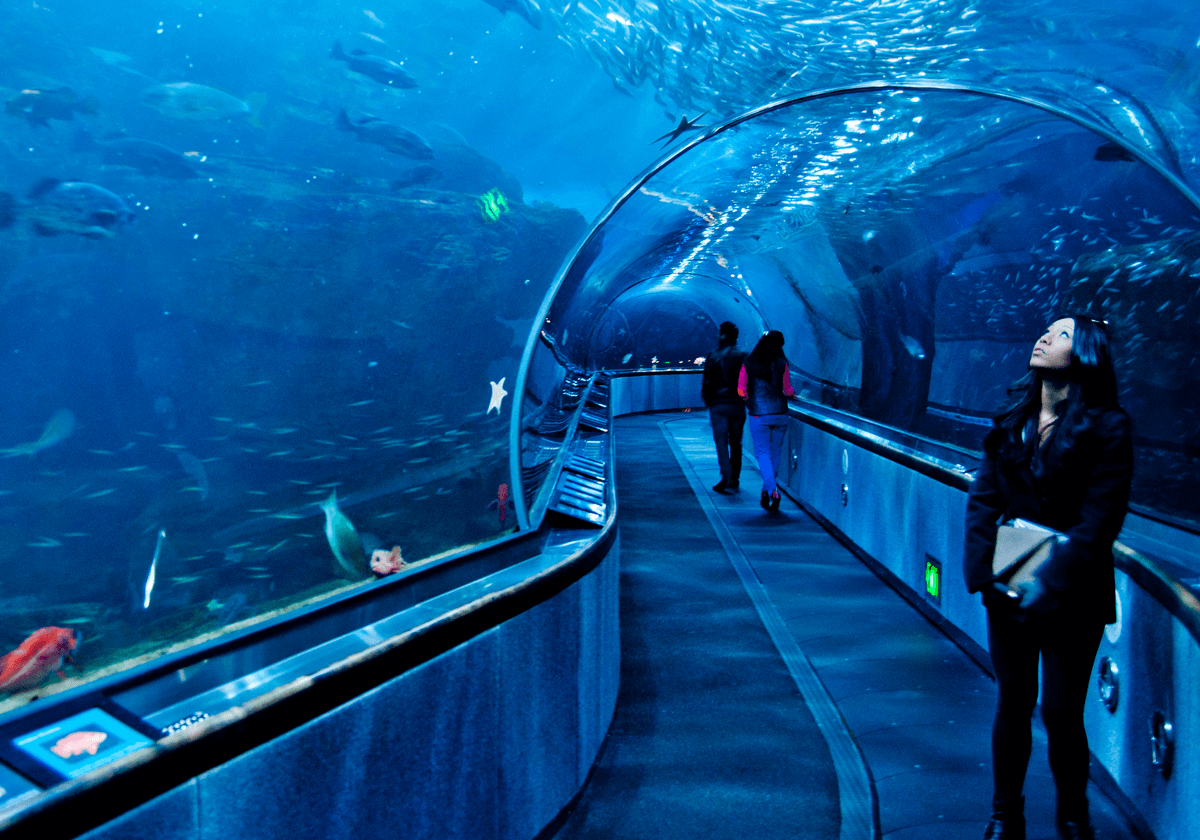

Underwater World at Pier 39 / San Francisco, California

ITPS was commissioned by the ownership group of Underwater World to provide a general examination of the facility operations, including the required steps to improve the overall profitability. Through on-site reviews, inspections and discussions with management, ITPS provided an initial Due Diligence report, addressing the Physical Property Assessment, Curatorial Program, and General Operations Review. ITPS also led an on-site Design Charrette leading to our overall recommendations for improvements. ITPS specifically made recommendations on general operations, product changes, design improvements, and visitor flow, resulting in stabilization of declines in attendance and revenues. Our guidelines as developed were followed and improvement occurred.

VisionLand Theme Park / Bessemer, Alabama

ITPS was retained by SunTrust Bank of Tampa, Florida (as Trustee for the West Jefferson Amusement and Public Park Authority) to conduct a Business/Operations Review of the VisionLand (now Alabama Adventure) operation in Bessemer, Alabama. The purpose of this review was to provide an examination of the overall business and operations at VisionLand, leading to any necessary recommended program changes that could potentially improve efficiency, productivity, service, and profitability. ITPS also conducted a property valuation of VisionLand. The purpose of this valuation was to provide an independent assessment of the value of VisionLand, based on the following approaches: (a) fair market value based on capitalized financial performance, and (b) fair market value, replacement value, and liquidation value based on equipment and property assets, both real and personal property. ITPS was also retained as sales agent to offer VisionLand for sale. As a result, the park sold at the ITPS estimated value of the property.

Lotte World / Seoul, South Korea

ITPS was retained by the Lotte World ownership to perform an Attractions Composition and Trends Analysis. The purpose of this assignment was to carefully examine Lotte World’s current attraction mix in terms of appropriateness, balance, general appeal, and adherence to global leisure trends as a foundation for future growth. To approach this assignment, ITPS first conducted an on-site review of the Lotte World operation, followed by preparation of a detailed analysis and recommendations. The end result was a detailed report that allowed Lotte World to make modifications which, when implemented, would strengthen the park’s niche in the marketplace, confirmed that it remains a regional leader in providing leisure entertainment, and ensured its proper positioning for future growth.

Reino Aventura / Mexico City, Mexico

Located in the western part of Mexico City, the Reino Aventura theme park opened in 1982 as the largest theme park in Latin America. By 1991, park management sensed the need for improvement and retained ITPS to provide an operational review, followed by an in-depth report that addressed recommendations for a major reconstruction and turnaround program. The park re-opened in 1992, after implementing the majority of the recommendations made by ITPS for improvements. In March 1999, Reino Aventura was sold to Premier Parks (then the holding company for all the Six Flags theme parks). After another major reconstruction, the park re-opened in 2000 as Six Flags Mexico.

Lake Compounce / Bristol, Connecticut

ITPS was retained by Kennywood, Inc. to develop a comprehensive design and masterplan for Lake Compounce (America’s oldest amusement park), to transform the park into a regional theme park with an historic theme. Incorporating Early American theming, a large water ride and a total of 27 other new rides/attractions were designed for implementation during the three phases of redevelopment.

Beijing Amusement Park / Beijing, China

Beijing Amusement Park, a 100-acre traditional amusement park located in Beijing, People's Republic of China, first opened in 1987. It was operated as a Sino-Japanese joint venture, and experienced severe financial shortfalls in the first two years of operation. ITPS was contracted by Kumagai Gumi Co., Ltd. (the major park investor) to consult with Price Waterhouse/Hong Kong/Beijing in order to provide short-range analyses and recommendations to halt the erosion of profits. ITPS provided a short-term plan that addressed the overall operational and financial goals of the park. ITPS also conducted an on-site analysis, which lead to the development of an operational action plan addressing improved efficiency, guest satisfaction and park performance. To help the park meet its goals, ITPS put into place an experienced General Manager for eight years to ensure that the operational action plan achieved the greatest possible results. As a result, profits improved significantly and ITPS was able to lead the park successfully for its tenure on-site. Specifically, attendance increased by 300% and gross revenues by 1500% during the first two years of the ITPS implementation plan. This new level of success and improvement was maintained during the ITPS on-site term of involvement.

Union Station / Kansas City, Missouri

Built in 1914, Union Station in Kansas City encompasses some 850,000 square feet. After being dormant for many years, today the facility offers restaurants, shops, permanent collections and archives, exhibits, a planetarium, and a science museum. ITPS was retained by the Board of Directors of the Union Station operation in Kansas City, Missouri to perform a Business Analysis and Strategic Operations Review. The need for such an undertaking was borne out of the facility’s significant financial problems at that time, as well as its underlying identity crisis. Specifically, the project was hemorrhaging at the profit line, burning its endowments and working capital. ITPS performed an on-site planning charrette and an on-site operational review leading to its suggestions for near-term profit enhancement, as well as strategic alternatives and opportunities. The recommendations submitted by ITPS related to trimming expenses, enhancing operating product, improving special events, and making important personnel changes. Union Station implemented the turnaround plan recommended by ITPS, which helped to stabilize the attendance decline and improved profitability.

Paramount Communications

Paramount Communications

Paramount Communications/Madison Square Garden contracted with ITPS on a fast-track basis to provide a complete due diligence valuation on these properties owned by Paramount:

• Kings Dominion – Richmond, VA

• Great America – Santa Clara, CA

• Carowinds – Charlotte, NC

• Canada’s Wonderland – Toronto, Canada

Based on the ITPS design/operating and management experience, not only did ITPS review and provide valuation for the assets, we also examined and reported on such issues as:

• Standard Operating Procedures;

• Capacities (Ride, Parking Lot, Food, Merchandise/Games);

• Safety/Maintenance;

• Live Entertainment;

• Data Processing;

• Financial Review (historical, current and future);

• Review of Debt Structure, Financial Statements, Tax Structures;

• Sponsorships;

• Advertising; and

• Staffing Levels, etc.

Contact ITPS

International Theme Park Services, Inc.

2200 Victory Parkway, Suite 500A

Cincinnati, Ohio 45206

United States of America

Phone: 513-381-6131

http://www.interthemepark.com

itps@interthemepark.com